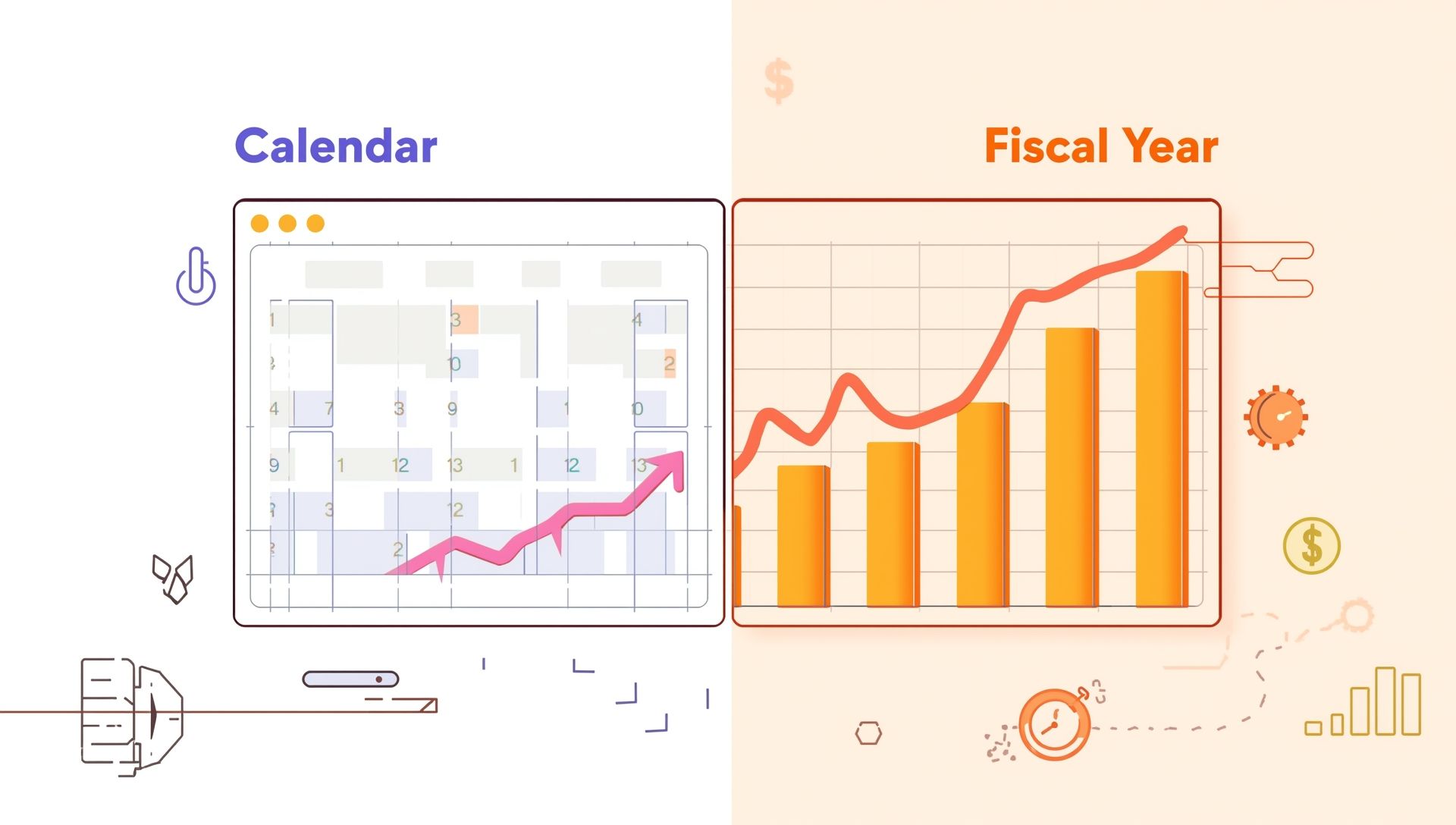

Most people live by the same rhythm. January to December defines the year, birthdays, holidays, and resolutions. Yet if you run a business, work in finance, or handle government budgets, your year may look completely different. That’s because not every year follows the Gregorian calendar we hang on our walls. Many organizations use a fiscal year instead, a system that keeps operations in sync with seasons, sales cycles, or reporting periods.

The calendar year runs from January 1 to December 31, while a fiscal year can start and end on any dates that suit an organization’s planning cycle. The difference affects taxes, budgets, and how performance is measured.

What Is a Calendar Year?

A calendar year is the familiar 12-month period that begins on January 1 and ends on December 31. It follows the modern evolution of calendar systems used internationally for civil and social life. Most individuals use this framework for everything from paying bills to filing taxes or tracking anniversaries. Governments also align many reporting systems with it, making it the default year in public life.

In a calendar year, quarters break down neatly: January to March, April to June, July to September, and October to December. This uniform structure simplifies planning for personal finance, public policy, and everyday recordkeeping.

What Is a Fiscal Year?

A fiscal year, sometimes called a financial year, is a 12-month accounting period that organizations use to track income, spending, and results. Unlike the calendar year, it can begin in any month and end 12 months later. Companies, governments, and nonprofits often choose fiscal years that match their business rhythm or regional workweek structures.

For example, a company that sells most products in winter might set its fiscal year to start in February and end in January. This allows them to close books after the busy holiday season. A farming business might start its fiscal year after harvest, when revenue patterns reset. The flexibility helps align reporting with real-world activity instead of fixed dates.

Not all fiscal years are the same worldwide. The United States federal government runs from October 1 to September 30. In contrast, the United Kingdom’s fiscal year runs from April 6 to April 5 of the following year, similar to how academic institutions organize their academic calendars.

Why Organizations Choose Fiscal Years

The main reason for using a fiscal year is practicality. Not every business or institution operates smoothly within the January to December framework. Seasonal patterns, industry trends, and cash flow cycles all influence when it makes sense to close the books.

- Retailers: Often end their fiscal year in January to capture full holiday sales in one accounting cycle.

- Universities: Commonly use a fiscal year that runs from July to June to align with the academic and budget cycle.

- Governments: Set fiscal years that simplify budget approvals and align with legislative sessions.

- Nonprofits: Choose fiscal years based on funding cycles or donor reporting schedules.

Choosing a fiscal year allows organizations to tell a clearer financial story. It avoids cutting off performance analysis in the middle of an operational season.

Calendar Year vs Fiscal Year: The Key Differences

Though both measure 12 months, their starting and ending points create distinct implications for accounting, taxation, and reporting. Below is a simple comparison that captures the contrast.

| Aspect | Calendar Year | Fiscal Year |

|---|---|---|

| Start and End | January 1 to December 31 | Any 12-month period (example: July 1 to June 30) |

| Used By | Individuals, small businesses, and most civil systems | Corporations, governments, nonprofits |

| Tax Filing | Personal income taxes often based on calendar year | Corporate taxes filed at the end of the organization’s fiscal period |

| Alignment | Follows the natural year and public holidays | Aligns with operational or industry cycles |

| Quarter Structure | Jan-Mar, Apr-Jun, Jul-Sep, Oct-Dec | Varies by start month |

If your business experiences strong seasonal swings, aligning your fiscal year with your busiest or quietest season can give you cleaner financial insights, similar to using a planner that fits your yearly rhythm.

Tax and Reporting Implications

The choice between calendar and fiscal year affects how taxes are filed and how performance is reported. Most individuals file taxes based on the calendar year, but corporations often get permission to use a fiscal year instead. This means their income and expenses are measured between custom start and end dates, not necessarily tied to January and December.

For example, a company whose fiscal year ends on June 30 reports taxes based on that 12-month period. Their financial statements, budgets, and forecasts follow the same rhythm. This approach allows managers to compare performance across consistent seasonal patterns, much like how digital calendars help structure yearly goals.

Governments also use fiscal years for budget planning. It helps them coordinate spending, pass appropriations bills, and evaluate results within legislative cycles rather than calendar boundaries.

Why the Difference Matters

Understanding whether an entity uses a calendar or fiscal year matters for investors, employees, and citizens alike. It influences when financial results appear, how taxes are calculated, and how public budgets are reviewed. Misunderstanding these periods can lead to confusion about performance or compliance deadlines.

For example, a business whose fiscal year ends in March might report strong profits in early summer. A competitor using a calendar year may not publish results until spring. Comparing the two directly without noting the time frame could give a false impression of which one performed better, just as time differences affect how we perceive events happening globally.

- Both fiscal and calendar years contain 12 months but can start on different dates.

- Governments use fiscal years for budgeting to match spending cycles.

- Companies can request tax authority approval to change their fiscal year.

- Fiscal years simplify analysis for industries driven by seasonal events and demand.

Choosing the Right Year for Your Organization

When deciding between a fiscal or calendar year, the key question is timing. Ask when your operations naturally begin and end. If your revenue and expenses follow predictable patterns, align your year accordingly. For instance, an agricultural business should not close its books mid-harvest, and a retailer should not end its year before holiday sales conclude.

Legal requirements also matter. In some countries, corporations need approval from tax authorities to adopt or change their fiscal year. Once established, the pattern must remain consistent for reporting accuracy.

- Analyze business cycles: Identify when revenue and expenses peak.

- Coordinate with partners: If suppliers or clients follow a specific calendar, it may be simpler to match it.

- Check legal rules: Tax codes differ by country and sometimes by industry, see how they vary in different countries.

- Review accounting software: Ensure systems can handle non-calendar cycles.

- Seek expert advice: Accountants can help determine the most beneficial setup for reporting and tax planning.

Calendar Year or Fiscal Year: Which Is Better?

There’s no universal answer. The best choice depends on context. Individuals and small service businesses often stick with the calendar year because it aligns with tax filings and social norms. Large corporations or seasonal industries may benefit from fiscal years that mirror their natural flow of business.

The goal is consistency. Once a year structure is chosen, it must remain stable for meaningful comparison. Changing it too often confuses records and can raise concerns with regulators, similar to shifting daylight saving schedules that throw routines off balance.

The Broader Meaning of Different Years

At its core, the difference between a calendar year and a fiscal year reflects how humans try to organize time around purpose. One is built for daily life, the other for planning and performance. The calendar year belongs to everyone; the fiscal year belongs to those who manage cycles of work, production, and budgets.

Both systems coexist to keep life and commerce in rhythm, much like how time zones structure global coordination. The calendar year measures living. The fiscal year measures doing.

Why This Distinction Shapes the World

Whether you are tracking your savings or reading a company’s annual report, knowing which year you are looking at matters. Governments base spending, taxes, and national priorities on fiscal cycles. Corporations set goals, bonuses, and dividends on theirs. Understanding these boundaries helps make sense of the world’s timelines.

So next time someone mentions a year-end report or a new fiscal budget, you will know that not all years are the same. Some mark the passing of seasons, while others mark the rhythm of enterprise, and both fit within the broader map of human timekeeping.